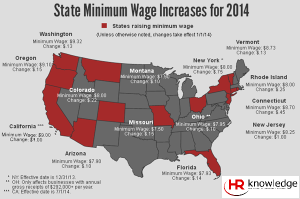

As we prepare for your first payrolls of 2014, we would like to make you aware of state minimum hourly wage changes that took effect on January 1, 2014 unless otherwise noted below. If you are a multi-state employer with operations outside of Massachusetts, it is important to know that many states provide annual increases to the State Minimum Wage based on the U.S. Consumer Price Index and inflation.

Current Federal Minimum Wage Rate

Under the Fair Labor Standards Act (FLSA), the current federal minimum wage is $7.25 per hour. However, because the FLSA does not supersede any state or local laws that are more favorable to employees, if a state has a minimum wage that is higher than the federal minimum, employers subject to the state minimum wage law are obligated to pay the higher rate to employees working in that state.

Minimum Wage Increased by State

Click here for a map that shows the states that have increased their minimum wages, including the new rate and amount of the increase.

- Arizona, to $7.90 for non-tipped employees and $4.90 for tipped employees

- California, to $9.00 for all employees (effective July 1, 2014)

- Connecticut, to $8.70 for non-tipped employees, $5.69 for service employees (waiters/waitresses at hotels and restaurants) and $7.34 for bartenders

- Florida, to $7.93 for non-tipped employees and $4.91 for tipped employees

- Missouri, to $7.50 for non-tipped employees and $3.75 for tipped employees

- Montana, to $7.90 for non-tipped and tipped employees

- New Jersey, to $8.25; employers subject to the Fair Labor Standards Act to $2.13 for tipped employees

- New York, to $8.00 (effective December 31, 2013)

- Ohio, to $7.95 for non-tipped employees and $3.98 for tipped employees (will apply to employers who gross more than $292,000 per year beginning in 2014)

- Oregon, to $9.10 for non-tipped and tipped employees

- Rhode Island, to $8.00 for non-tipped employees and $2.89 (no change) for tipped employees

- Vermont, to $8.73 for non-tipped employees and $4.23 for tipped employees

- Washington, to $9.32 for non-tipped and tipped employees

Localities

Certain localities also have implemented minimum wage legislation. For example, in San Francisco, the minimum wage increased on Jan. 1 from $10.55 to $10.74 an hour, and San Jose, California, increased its minimum wage from $10 to $10.15 an hour. (California law does not allow employers to take a tip credit against minimum wage for tipped employees.) In addition, the Albuquerque, New Mexico minimum wage increased from $8.50 to $8.60 effective Jan. 1. However, the minimum wage in Albuquerque is $7.60 if an employer provides healthcare and/or childcare benefits to the employee during any pay period and the employer pays an amount for these benefits equal to or in excess of an annualized cost of $2,500. Minimum wage for tipped employees increased from $3.83 to $5.16.

Key Next Steps:

- Clients should inform your HR Knowledge Client Account Manager of any employees’ hourly rates that need to be changed to meet the new state minimum wage requirements as we must provide the new rate to ADP with the first payrolls with a check date on or after January 1, 2014 (and December 31, 2013 for NY).

- If you process your own payroll, please note that when you submit these payrolls, you must make any necessary changes to the employees’ rates by entering the new rate in the Pay Rate field found on the Payroll Info page under the Employees tab.

- Employers should check to see if they have the most recent version of the HR Knowledge All-in-One posters (if your current poster does not have a HR Knowledge logo, it is NOT the most recent version of our poster.)

- If you operate in a state that has an increase effective January 1, 2014, order the Peel-N-Post overlay ($8.95) OR the most recent version of our All-in-One poster ($49.99 + shipping) by contacting HR@HRKnowledge.com.

For additional resources click here.

This content is provided with the understanding that HR Knowledge is not rendering legal advice. While every effort is made to provide current information, the law changes regularly and laws may vary depending on the state or municipality. The material is made available for informational purposes only and is not a substitute for legal advice or your professional judgment. You should review applicable laws in your jurisdiction and consult experienced counsel for legal advice. If you have any questions regarding this advisory, please contact HR Knowledge at 508.339.1300 or email us at HR@hrknowledge.com.