A question we are often asked is how long do I need to retain our employee Form I-9s?

Uscis.gov states that the Form I-9 “should be retained for three (3) years after the date of hire, or one (1) year after the date employment ends-whichever is later.” But what does this mean? To many employers, this is confusing. In simple terms, this means: current, employees should always have an I-9 on file; only after they are terminated should employers begin to calculate the retention requirements.

Do We Need to Comply?

All “employers” are required to comply with the Form I-9 requirements, including record retention.

Employers’ Compliance Obligations

According to the U.S. Citizenship and Immigration Services (USCIS), “U.S. employers are required by law to verify the employment authorization of all workers they hire on or after November 6, 1986, for employment in the United States, regardless of the workers’ immigration status.” This required authorization verification is done via the Form I-9.

Storage of Form I-9s

Form I-9s should be maintained separately from employee personnel files. Most often, I-9s are maintained in an electronic or hard copy file. We recommend utilizing two three-ring binders that are accessible only to a few individuals in the human resources department.

- The first three-ring binder would include your active employee Form I-9s. Active employee I-9 records are often maintained alphabetically by last name so that they can be easily audited against a current payroll list.

- The second three-ring binder is for your terminated employee Form I-9s. When an employee is terminated, pull his or her Form I-9 from the active employee section and file in the terminated I-9 binder.

Determine Retention Requirements for Terminated Employees

Once an employee no longer works for the employer, the employer must determine how much longer to keep the employee’s Form I-9.

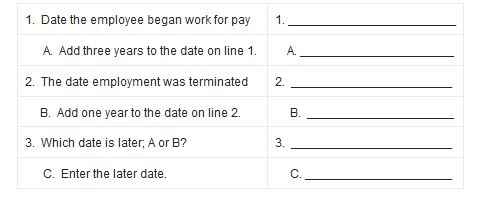

To calculate how long to keep an employee’s Form I-9, enter the following:

The employer must retain Form I-9 until the date on Line C.

Example

John Doe is hired on 5/14/07 and is terminated on 2/9/14. Using the calculation above we will determine how long to keep John Doe’s Form I-9 on file.

1. Date John Doe began work for pay: 5/14/07

A. Add three years to the date of hire: 5/14/10

2. The date John Doe’s employment was terminated: 2/9/14

B. Add one year to the date of John Doe’s termination: 2/9/15

3. Which date is later; A or B? Date B is later

C. Enter the later date: 2/9/15

The retention date should read “Retain until 2/09/15.”

Key Points and Next Steps for Employers

- Retain Form I-9s on file for all ACTIVE employees indefinitely

- Determine record retention dates for TERMINATED employees only

- File your terminated I-9s chronologically according to their retention date

- Shred only those I-9’s that have retention dates have passed for terminated employees only

- Download a copy of the current I-9 Handbook for Employers at http://www.uscis.gov/sites/default/files/files/form/m-274.pdf.

This content is provided with the understanding that HR Knowledge is not rendering legal advice. While every effort is made to provide current information, the law changes regularly and laws may vary depending on the state or municipality. The material is made available for informational purposes only and is not a substitute for legal advice or your professional judgment. You should review applicable laws in your jurisdiction and consult experienced counsel for legal advice. If you have any questions regarding this advisory, please contact HR Knowledge at 508.339.1300 or email us at HR@hrknowledge.com.