Background

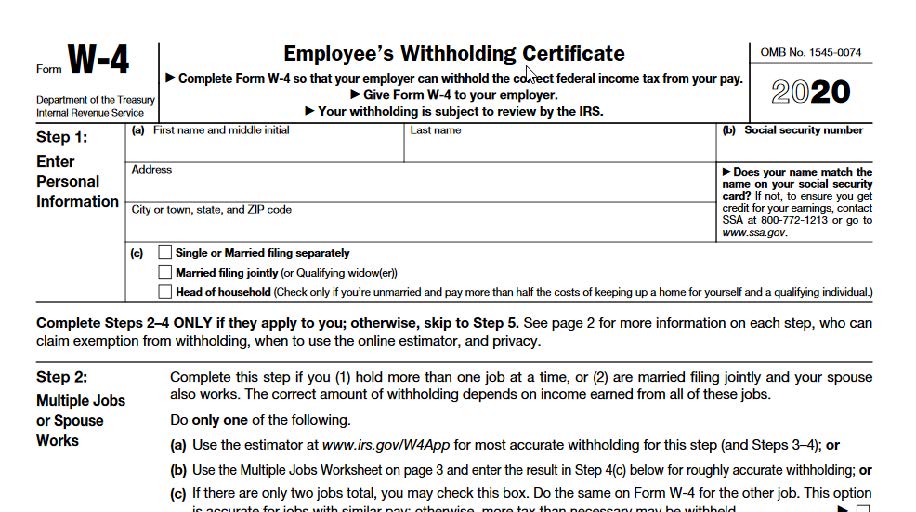

On December 5, 2019, the Internal Revenue Service (IRS) released the final 2020 W-4, Employee’s Withholding Certificate. The new form no longer uses withholding allowances and it provides for simplified and more accurate income-tax withholding for employees starting next year. The IRS had released some earlier drafts in May and August of this year to enable employers to make payroll software changes.

Summary

The IRS updated the W-4 form to reflect tax rates, deductions, tax credits, and personal exemptions that changed in the Tax Cuts and Jobs Act (TCJA), which took effect last year. The revised form excludes withholding allowances and replaces the complicated worksheets with more straightforward questions. The primary goal for the change was to provide simplicity, accuracy, and privacy for employees and to minimize the burdens for employers and payroll processors.

Major Changes to the 2020 Final Form W-4 include:

- The number of withholding allowances is eliminated

- A new Marital and Head of Household status with new tax tables for these statuses have been added

- Lines to claim exemption from tax withholding were removed

- New questions were added regarding multiple jobs or a two-earner household

The 2020 Form W-4 has a five-step process which includes declaring additional income, so employees can adjust their withholding with more accuracy. These steps are:

- Step 1. Enter personal information

- Step 2. Indicate multiple jobs or any income from a spouse

- Step 3. Claim dependents

- Step 4. Make other adjustments for

- Investment and retirement income

- Deductions other than the standard deduction

- Any extra tax withholding per pay period

- Step 5. Sign the form

The IRS explained that the only two steps that an employee must complete are Steps 1 and 5. However, if the employee chooses to include Steps 2, 3, and 4, their withholding will more accurately match their tax liability.

Existing Employees:

Existing employees will not be required to complete a new Form W-4 for 2020. Employers will continue to observe the withholding allowances and filing status elected by employees who completed a pre-2020 Form W-4.

New Employees and Changes:

As of January 1, 2020, all new employees hired and any current employees who make any adjustments to their withholdings on or after this date must complete the new form.

Next Steps for Employers

- Communicate these changes to anyone involved in the hiring process, so they are all aware of the new form.

- Correspond with your payroll provider regarding the new W-4 form; if you are a Full-Service or Managed Payroll client of HR Knowledge, we will handle this for you, and ADP Workforce Now will be ready to support the 2020 Form W-4 on December 14, 2019.

- Should you need assistance, please reach out to your Client Account Manager or email us.

The People Simplifying HR

For almost twenty years, HR Knowledge has made it our mission to demystify the complex and daunting process of HR management. We do more than just provide the level of service and technology you’d expect from an industry leader.

We combine an unparalleled passion for service with our decades of HR, payroll, and benefits experience to provide our clients with personalized and actionable advice that is second—to—none.

From managed payroll to employee benefits to HR support, we can help your organization thrive, grow, and reduce operating costs — no matter what industry you serve. Whether you’re interested in our Full-Service solution or just need your employee handbook written, HR Knowledge can help you minimize risk while staying on top of compliance regulations.

The bottom line? We’re not just another cloud-based technology company that also does HR, #WeAreHR.

This content is provided with the understanding that HR Knowledge is not rendering legal advice. While every effort is made to provide current information, the law changes regularly and laws may vary depending on the state or municipality. The material is made available for informational purposes only and is not a substitute for legal advice or your professional judgment. You should review applicable laws in your jurisdiction and consult experienced counsel for legal advice. If you have any questions regarding this content, please contact HR Knowledge at 508.339.1300 or email us.

DOWNLOAD PDF